Smokers are different: The impact of price increases on smoking reduction and downtrading

Crespi F., Liberati P., Paradiso M., Scialà A., Tedeschi S., 2021 – Economic Modelling

The Italian Ministry of Health announced several measures to tackle smoking, with the aim of reducing the population of smokers to below 5 per cent by 2040, in line with the European Plan Against Cancer 2021. All the measures point to tightening the restrictions introduced by Law 3/2003 (the so-called Sirchia Law), which means banning smoking. For the time being, no reference is made to market measures related to the taxation of tobacco products and, hence, to the possibility of affecting smoking via an increase in the price of tobacco products. In addition, it should be noted that, in the latest budget law, action has also been taken on tobacco taxation, yet, in the direction of slowing down the increase in taxation compared to the provisions of the previous legislation.

In the economic and medical literature on tobacco control, there is a broad consensus that price is the main variable influencing smokers’ behaviour. However, the effects of taxation of tobacco products on price structure and dynamics are controversial. This is related to at least three factors: the complexity of the structure of the taxation of tobacco products; the duopolistic regime of the market; the stabilization of revenue, which remain relevant for policy-makers, together with the health objective. In general, to understand the effect of taxation on tobacco consumption, it is necessary to identify the mechanisms by which the tax is passed on to prices and, hence, how smokers react to price changes.

In a recent study, “Smokers are different: The impact of price increases on smoking reduction and downtrading”, published in Economic Modelling, Francesco Crespi, Paolo Liberati, Massimo Paradiso, Antonio Scialà and Simone Tedeschi analyse the relationship between an increase in the price of cigarettes and a reduction in consumption, using data collected through an ad hoc survey on consumption habits of a representative sample of smokers. There are three main findings.

First, the price elasticity of cigarette demand increases with the magnitude of the price change in a range between 0.2 (for a price increase of 10 cents per pack) and 0.9 (for a price increase of 50 cents per pack).

Second, different categories of smokers react heterogeneously to an increase in the price of cigarettes. Through a latent class conditional Logit model, smokers are clustered into five groups according to their behaviour: random smokers, risk unconcerned smokers, risk concerned smokers, stable smokers, and intensive smokers. The price elasticity of consumption ranges from a value of 0.07 for habitual smokers to 2.67 for occasional smokers.

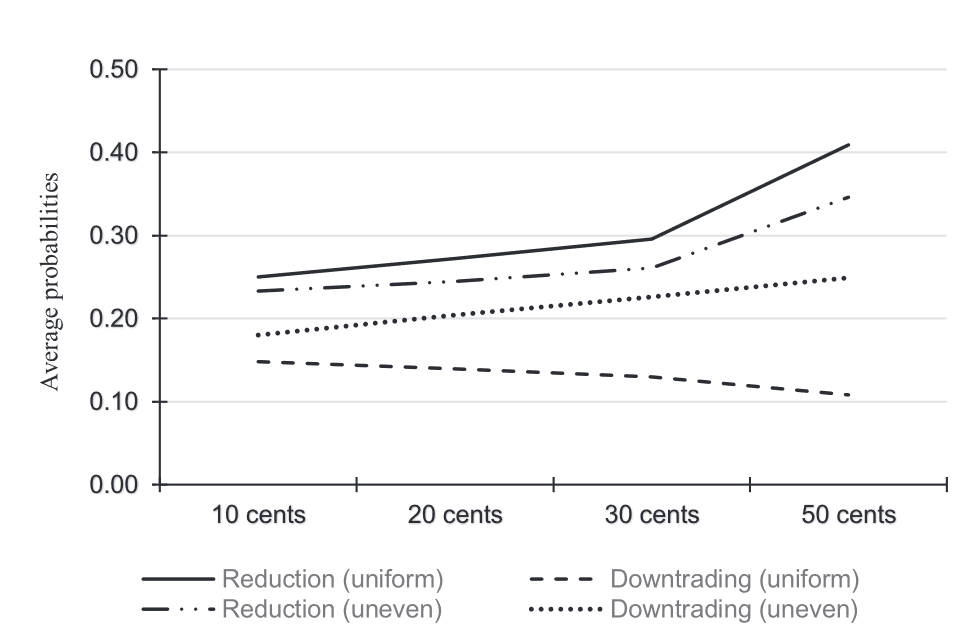

Finally, the relationship between price increase and reduction in consumption may differ, depending on whether the price increase is uniform across cigarette brands or uneven between brands, thus altering the relative prices between cigarettes of different brands. As shown in Figure 1, compared to an uneven price increase, on average, a uniform price increase is associated with a greater probability of a reduction in consumption. The difference between the effect of a uniform and an uneven price increase on the probability of reducing consumption is greater the higher the size of the increase is. Furthermore, smokers may also react to the price increase by substituting cigarettes of more expensive brands for less expensive cigarettes, thereby keeping their overall expenditure stable for the same number of cigarettes smoked. As Figure 1 shows, the likelihood of observing this behaviour is higher in the presence of an uneven price increase than in the scenario of a uniform price increase.

Should the policy-maker consider interventions on cigarette taxation, these findings may provide some insightful indications. It should be noted that cigarette consumption is taxed by both VAT and an excise tax harmonized at the European Union level. In particular, the excise tax embeds two components: a per-unit component related to the quantity consumed, and an ad valorem component related to the retail price. In a duopoly, attaching greater weight to the ad valorem component of excise tax favours the emergence of equilibria characterised by high quantities and low prices; conversely, attaching a greater weight to the per-unit component favours the emergence of equilibria characterized by high prices and low quantities. Depending on how the excise tax is manipulated, it may induce either a uniform price increase across the main brands, or a differentiated increase that changes the price of some brands relative to that of others. In this regard, a speculative conclusion is that per-unit taxes are more likely to promote uniform price changes and, consequently, a greater reduction in consumption.

All this has very different implications for health policies aimed at reducing tobacco consumption, according to the design specifically adopted for tobacco excise duty, which is still significantly unbalanced in favour of the ad valorem component in the Italian case. The objective of reducing cigarette consumption would require revising the current excise tax structure to increase the weight of the specific component and reduce that of the ad valorem component. In addition, such changes should also favour a uniform price increase across brands, thus fostering a reduction in consumption and discouraging the observed down-trading behaviour. Since the results of the analysis reveal significant heterogeneity in both individual response probabilities and estimated price elasticities of demand, tax policies may be more effective for some categories of smokers. The data suggest that the response to price changes and the elasticity of demand are much higher for young smokers. Thus, to some extent, the use of tax policy to trigger a reduction in smoking appears to be more effective as far as young smokers are concerned. This is a valuable outcome when considered with respect to health targets and long-run reduction of consumption. One further implication is that tax policies cannot be left in isolation when the target is to reduce consumption in the long run. In particular, anti-smoking campaigns and command-and-control measures could be usefully associated with tax policies, especially because the heterogeneity of smokers’ responses to prices makes tax policies unequally effective across individuals.