Fiscal decentralization and income (re)distribution in OECD countries’ regions

Pietrovito F., Pozzolo A.F., Resce G., Scialà A., 2023 – Structural Change and Economic Dynamics

On June 19, 2024, the Italian Parliament approved Law 86, introducing “asymmetric federalism” into the country’s legal system, aimed at implementing the provisions of Article 116, third paragraph, of Title V of the Constitution, as reformed in 2001. This reform has sparked significant debate, leading to a proposal for an abrogative referendum, with over a million signatures collected by proponents. Critics argue that accelerating the process of fiscal decentralization could negatively affect regions that do not request greater autonomy, particularly in Southern Italy.

One aspect that has received little attention is the potential intra-regional redistributive effects arising from a greater degree of fiscal decentralization. In fact, this issue has generally been underexplored in the economic literature on fiscal decentralization, with some exceptions.

In a recent study, “Fiscal Decentralization and Income (Re)Distribution in OECD Countries’ Regions”, published in Structural Change and Economic Dynamics, Filomena Pietrovito, Alberto Pozzolo, Giuliano Resce, and Antonio Scialà investigate the relationship between fiscal federalism and within-region income redistribution. Redistribution is measured by the difference between the Gini index on market incomes and the Gini index on after-tax and transfer incomes. The same analysis is also performed replacing market incomes with the Gini index on gross incomes (including public transfers, such as public pensions).

To this end, the authors perform an empirical analysis on 183 regions from a sample of 14 OECD countries, using two alternative measures of tax decentralization: the Regional Authority Index (RAI) and the share of regional and local tax revenue relative to general government tax revenue. The RAI is an institutional index measuring the degree of tax autonomy assigned to sub-central governments, specifically their ability to define the tax base, rate, and allowances on decentralized tax items. The latter is a quantitative measure aimed at assessing the proportion of tax allocated for the financing of sub-central governments, independently of the actual ability of local policymakers to modify tax schedules.

The authors also investigate the extent to which the relationship between intra-regional redistribution and tax decentralization is affected by the overall amount of resources managed by local authorities, measured by per-capita local public spending.

Finally, a disaggregated analysis of the role of individual tax items is provided. Specifically, local tax revenues are broken down into personal income tax, corporate income tax, property tax, and indirect taxes.

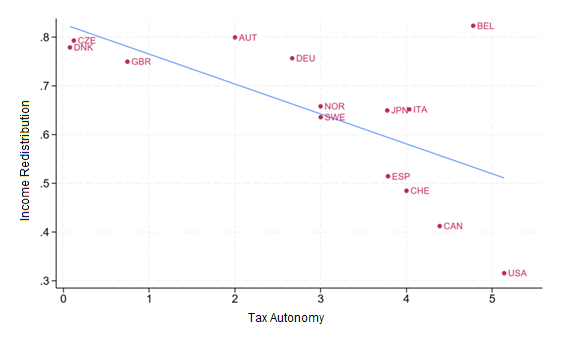

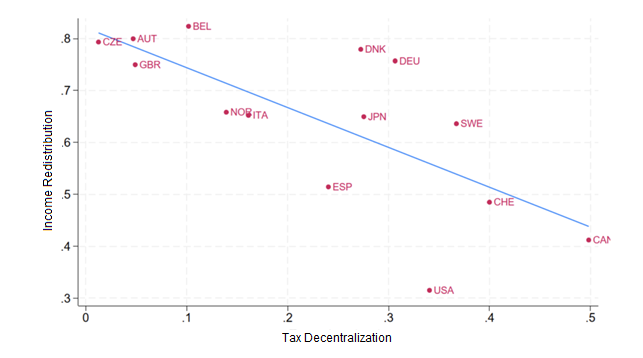

The study presents four main findings. First, a significant negative relationship between tax decentralization and within-region redistribution emerges. Figures 1 and 2 provide preliminary visual evidence for this result, which is confirmed by econometric analysis, controlling for country-level factors (total government spending as a percentage of GDP, total tax revenue as a percentage of GDP, and local public expenditure as a percentage of GDP) and regional-level factors (GDP per capita and elderly dependency ratio).

Second, when splitting the sample by per-capita local public expenditure (i.e., separating countries above the median from those below the median), the authors find that the relationship is not significantly affected by the amount of resources managed by local policymakers.

Third, interestingly, for countries with higher local per-capita public spending, the redistributive effect operates in the opposite direction to that of local taxation: beyond a certain threshold, higher local spending is associated with greater intra-regional redistribution.

Fourth, when local taxes are broken down by type, the overall effect is driven by the decentralization of personal income tax, indirect taxes, and property tax, while corporate income tax appears to operate in the opposite direction. Specifically, a change in the share of local revenues from the 25th percentile (less than 1%) to the 75th percentile (nearly 15%) is associated with a 3.2 percentage point decrease in the Gini index. Corporate taxation, however, shows a sizable impact in the opposite direction: an interquartile change from 0 to 3.4% is associated with a 2.1 percentage point increase in the Gini index. Indirect taxation and property taxation are associated with comparable decreases in the Gini index—1.8 percentage points (for a change from 1.4% to 6.9%) and 1.6 percentage points (for a change from just above 0 to 5.6%), respectively.

In conclusion, these findings suggest that the effect of higher regional autonomy, as implied by the Italian reform, on intra-regional redistribution is ambiguous. In regions that gain a greater autonomy, increased revenues from local taxation may reduce redistribution, whereas greater autonomy on the expenditure side could enhance redistribution, but only if sufficient public resources are made available for local-level spending.