Incentives for Voluntary Health Insurance in the National Health System: Evidence from Italy

Marenzi A., Rizzi D., Zanette M., 2021 – Health Policy

Private health expenditure in Italy, whether out-of-pocket or intermediated by voluntary health insurance and mutual health funds, significantly increased in the last decade, with total health expenditure rising from 21.5% in 2010 to 24.1% in 2022 (OECD, 2023). In the Italian tax system, private expenditures benefits from tax and social security incentives, which have progressively expanded in recent years, partly due to the introduction of supplementary health plans in collective labour agreements.

In countries where the private sector is the primary provider of citizens’ health coverage, fiscal subsidies are mainly justified on the ground of equity, as a tool to encourage the adoption of private health insurance even by the less affluent individuals. More controversial, from an equity point of view, is the use of these tax incentives in universal healthcare systems, in which all citizens have access to free healthcare and equal standards of healthcare services. Fiscal subsidies (tax expenditures) are a benefit granted to someone, and a burden, in terms of loss of revenue, for all taxpayers. Therefore, whether or not the same amount of money could have been better used to improve the NHS’s level of healthcare deserves assessment. Whereas the primary purpose of the tax benefits is not a redistributive one, it is interesting to explore whether such benefits could impact income redistribution and health inequality.

In a recent work entitled “Incentives for Voluntary Health Insurance in the National Health System: Evidence from Italy” and published in the journal Health Policy, Anna Marenzi, Dino Rizzi, and Michele Zanette provide an estimate of tax relief granted to individuals and employers who participate in supplementary health funds, assess their redistributive impact, and quantify their impact on tax revenue.

The paper considers the two types of supplementary funds of the Italian NHS that provide different healthcare services and enjoy different tax incentives, type A and type B. The former can only provide complementary healthcare services and the contributions paid are deductible from the personal income tax. The latter also provide services that can replace NHS services and guarantee tax advantages for both employees and employers who purchase insurance policies for their employees (lower social security contributions and income taxes).

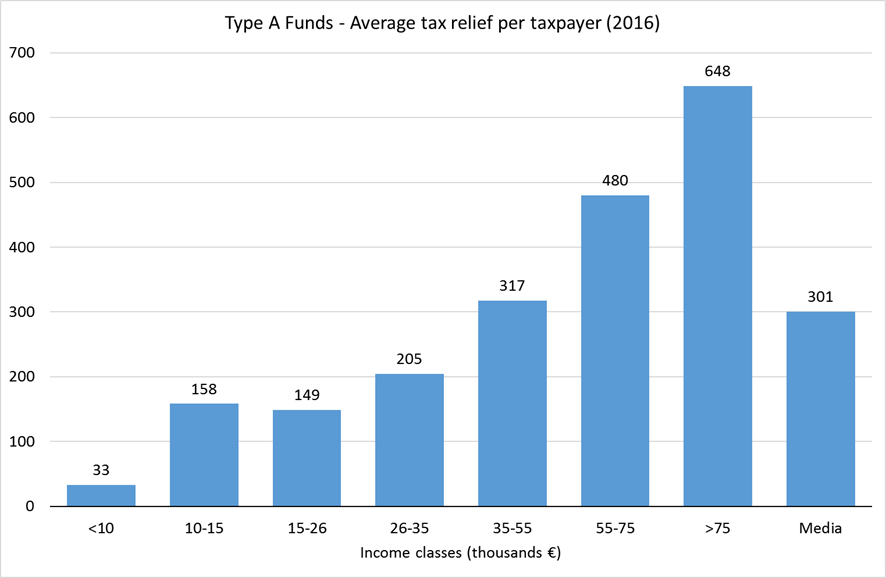

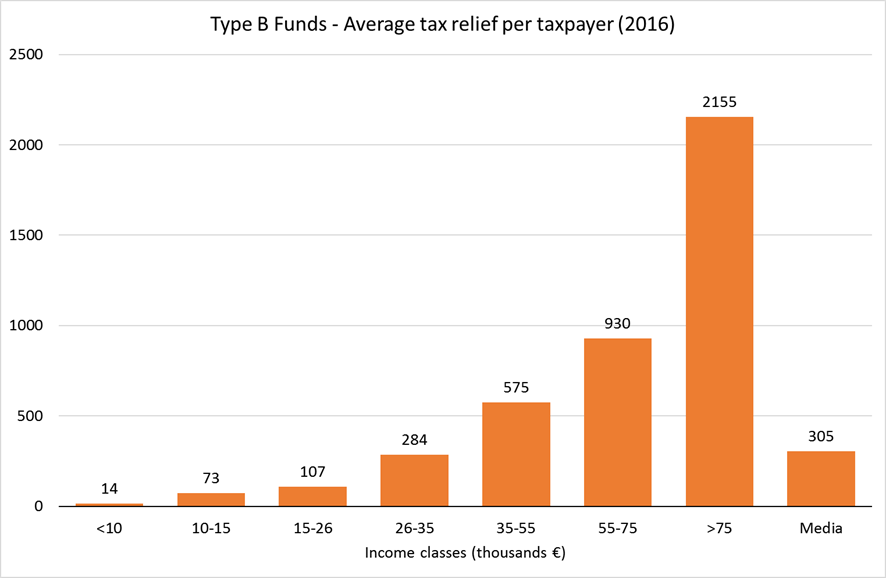

Using data on tax returns of the universe of Italian taxpayers for the years 2009-2016, the authors estimate an overall relief for individuals and employers of about 1,280 million and 2,580 million euros depending on the hypothesized scenario. The redistributive effect of tax relief shows a clear regressive profile, as highlighted in the figures 1 (type A funds) and 2 (type B funds) for the year 2016.

The average values of the tax benefit by income class are clearly increasing for both type A and type B funds. Inequality in the distribution of tax reliefs highlights that the poorest 80% of taxpayers, who receive around 50% of income, receive only 13% of tax reliefs from type A funds and 25% of tax reliefs from type B funds. The study shows that tax reliefs also introduced some sources of horizontal inequality. Depending on their negotiating skills, some taxpayers can get better access to care than others with the same ability. People who do not work, those who work for companies that do not offer health fund, and those who do not have sufficient income to afford a health insurance policy are excluded from this kind of benefit.

Although supplementary health funds are an increasingly important component of the Italian health system, their impact on the demand for health services, on the structure of the NHS and on the health of citizens has not yet been well defined, nor has the essential issue of inequality of access to healthcare. The development of health funds in Italy has been driven mainly by type B funds provided through collective agreements or unilateral decisions by employers. Tax reliefs granted to these funds are often welcome as a “win-win solution for all”, as they reduce both employees’ income tax and employers’ labour costs, favouring the solution of pay disputes. Trade unions often exchanged more occupational welfare, particularly health care coverage, for less remuneration. However, workers give up income increases to obtain health services that ideally should be guaranteed by the NHS and they also give up long-term benefits such as pensions and severance pay.

In recent years, the growth of supplementary healthcare funds has been substantial: the number of members has doubled from 7.5 million in 2015 to 15.6 million in 2021, contributing to the ongoing trend of privatizing the healthcare sector. Unfortunately, there is a significant lack of information regarding supplementary healthcare funds, preventing a precise estimate of their impact on the public budget as well as on income and health inequalities. Finally, it is worth noting that the legislation is rather complex and leaves room for undesirable mixing between the non-profit sector of supplementary funds and the for-profit sector of private insurance companies.