The determinants of the financial distress of Italian municipalities: how much is it due to inadequate resources?

Padovani E., Porcelli F., Zanardi A., 2024 – International Tax and Public Finance

In the last fifteen years, a significant share of Italian municipalities—around 5% of the total each year—have been declared in financial distress (dissesto) or have activated the multi-year financial recovery procedure (known as predissesto), especially in the southern regions (Mezzogiorno) and in larger municipalities. However, the official data on legal cases of dissesto or predissesto represent only the tip of the iceberg of a widespread state of financial strain affecting a number of Italian municipalities. The tendency of local governments to delay declaring financial distress as much as possible, the widespread practice of significant treasury advances provided by banks to support municipal finances, and central government rescue interventions conceal a broader picture of financial challenges. These issues can be analyzed using multiple financial indicators commonly employed by oversight bodies and private operators who interact with municipalities to assess their financial health.

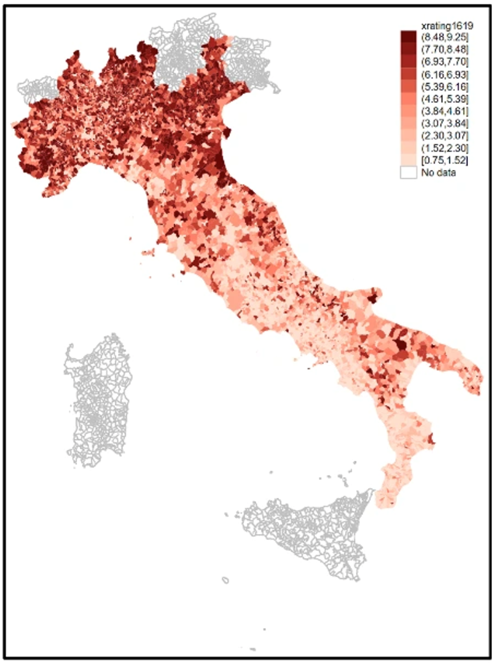

The map highlights municipalities in regions under ordinary statute with the poorest financial health (average for the period 2016–2019), where darker shading indicates better conditions based on the financial ratings published by AIDA-PA.

What are the causes of these critical financial conditions affecting municipalities?

In a recent study titled “The determinants of the financial distress of Italian municipalities: how much is it due to inadequate resources?”, published in International Tax and Public Finance, Emanuele Padovani, Francesco Porcelli, and Alberto Zanardi investigate the determinants of financial distress in Italian municipalities, focusing on the role played by the inadequacy of fiscal resources available to individual municipalities to meet the expenditure needs associated with their core public functions (e.g., local welfare, road maintenance, public transport, local police).

Municipalities have often pointed to the severe underfunding, resulting from the resources allocated by the central government, as one of the primary causes of their financial difficulties. The analysis exploits the variability across municipalities in the effects—both current and prospective—on financial resources caused by two recent innovations in Italy’s decentralized finance system: the first relates to the substantial cuts to vertical transfers implemented by the central government as part of its fiscal consolidation strategy during 2014–2015, which affected individual entities to varying degrees. The second deals with the introduction in 2015 of a new municipal equalization grant system, based on expenditure needs estimated using structural characteristics of each local government. This mechanism allows for measuring the gap between local needs and available financial resources.

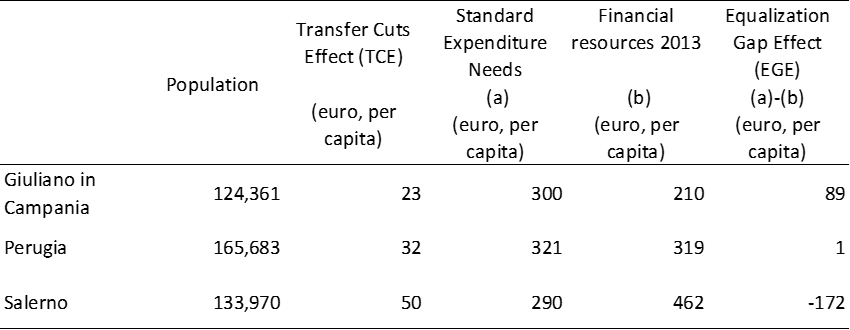

To illustrate the heterogeneity among municipalities regarding these two measures of financial resource inadequacy, the table compares three municipalities of similar demographic size: Giuliano in Campania, Perugia, and Salerno. While the cuts to transfers (Transfer Cuts Effect – TCE) increase from the first to the second and then to the third municipality, the application of the equalization system (Equalization Gap Effect – EGE) reveals that Giuliano in Campania had significantly fewer resources than its expenditure needs in the base year (2013), whereas Salerno experienced the opposite situation. In Perugia, resources and expenditure needs were substantially aligned.

Exploiting this heterogeneity, the econometric analysis shows that, during the analyzed period (2016–2019), municipalities with structurally lower levels of resources compared to what is required to provide public services at a standard level have, ceteris paribus, a higher probability of experiencing financial distress. Similarly, cuts to central government transfers exacerbate financial vulnerability at the municipal level. Both types of resource inadequacy can be considered exogenous to the behavior of mayors: the lack of equalization funds because it was prospective and not yet resolved during the investigated period, and the fiscal consolidation because it occurred prior to the investigated period and was driven by largely linear distribution criteria.

These findings are consistent both with legal procedures for dissesto and predissesto and with a range of financial indicators capable of capturing the multidimensional nature of financial strain at the local level (e.g., budgetary imbalances, cash flow difficulties, and rigidity caused by long-term debt).

In line with other studies, alongside these specific insights regarding the role of resource inadequacy in driving financial difficulties at the local level, the analysis confirms that another important determinant of municipal default is the level of efficiency of municipal administration. This efficiency is measured here as excessive expenditure relative to the outcomes achieved in terms of actual services delivered to citizens, using indicators published on opencivitas.it.

In terms of policy design for financing decentralized governments, the analysis shows that the introduction of a robust fiscal equalization mechanism, capable of fully closing the resource gap among differently endowed municipalities, is not only consistent with the objectives of territorial equity but also an important prerequisite for orderly managing municipal finances. This would prevent municipalities from being exposed, to varying and unjustified degrees, to the risk of financial distress.

This study contributes to the ongoing debate over the past few years, which has led to the formulation of a proposal for reform of financial crisis management tools contained in the draft law delegating the Government to revise local authorities’ laws. In particular, the reform proposal should consider, in line with the findings of this study, the critical role of equalization grants. To this end, it would be appropriate to develop mechanisms that enable the preventive transfer of additional resources, rather than intervening only after a financial crisis has already materialized. Currently, such resources are provided through instruments like the Fondo di rotazione for municipalities in predissesto and other funds created over time to support municipalities in dissesto. By intervening early through the proactive activation of equalization mechanisms for municipalities showing symptoms of financial stress—identified through indicators used by the Court of auditors and employed in this study—it would be possible to help prevent financial difficulties from arising.