The sacred and the profane of budget cycles: evidence from Italian municipalities

Revelli, F., Zotti, R., 2019 – International Tax and Public Finance

The idea that incumbent governments time their fiscal policies in order to signal their competence and boost their re-election chances is not new in the political economy literature of the past decades. What has increasingly emerged in recent research is the interest on the relationship between the political budget cycle and local circumstances and characteristics, such as social capital. Indeed, social capital is recognized to play a central role in improving the quality of public policies through active participation and monitoring, strengthening the accountability of elected officials, and possibly weakening the incentives of budget manipulation.

Is it possible to detect a consistent link between local elections and social-capital-boosting recurrent events?

In a recently published paper, The sacred and the profane of budget cycles: evidence from Italian municipalities, in International Tax and Public Finance, Federico Revelli and Roberto Zotti empirically investigate the consequences of annual traditional religious celebrations, Patron Saints Days, on the political budget cycle and the scheduling of key municipal fiscal decisions by incumbent governments at the municipal level in Italy.

The analysis is made possible thanks to a rich panel dataset of over 8000 Italian municipalities during the period 2007–2015 containing detailed information on the timing (day of the year) of all municipal elections (from the Italian Ministry of Interior), of the fundamental fiscal policy decisions by incumbent mayors and budget indicators of municipalities (ISTAT and Department of Finance of the Italian Ministry of Economy and Finance), and of each municipality’s Patron Saints Day (from the Italian Municipality database).

In order to catch fiscal policy decisions by incumbent mayors, the authors focus on two main fiscal instruments, the local property tax and, more importantly, the surcharge on the national personal income tax. Thanks to a decentralization process that has interested the Italian fiscal system in the last twenty years, each municipality is able to act on these two sources of revenue, either raising or cutting them.

The analysis develops as follows.

First of all, the authors focus on three municipal budget variables that might be strategically maneuvered by incumbents, namely: the degree of financial autonomy (defined as the ratio of revenues from taxes, fees, and charges over total revenues), the degree of taxation autonomy (defined as the ratio of tax revenues over total revenues), and the budget surplus (as a percentage of total revenues). The analysis confirms that a political budget cycle exists, characterized by pre-electoral fiscal expansion and post-electoral austerity. In other words, the chosen indicators of fiscal effort fall before the elections and increase after them, while municipal budgets deteriorate before the elections to improve thereafter.

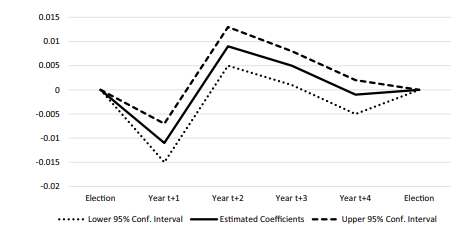

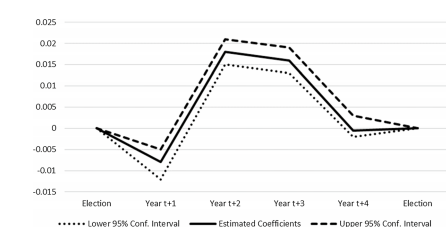

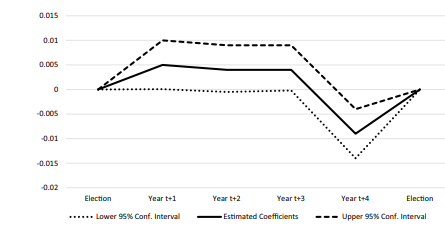

This effect is clearly detectable looking at the following figures. The indices of revenue-raising effort of municipal governments such as financial autonomy (Figure 1) and taxation autonomy (Figure 2) fall before the elections and rise after the elections, peaking around the second year after the elections and declining thereafter. The budget surplus (Figure 3) improves after the elections and in the subsequent three periods and deteriorates when the next election approaches.

Figure 1 Degree of financial autonomy

Figure 2 Degree of taxation autonomy

Figure 3 Budget surplus

Then, the analysis focuses on the role of social capital in shaping the timing of fiscal policy-making. In particular, the authors test whether the decisions about the local income tax rate are more or less likely to be slated in the proximity of events — like traditional celebrations of Patron Saints — that can be believed to foster the degree of social participation, cohesion, and connectedness of the polity. To do so, thanks to the staggered scheduling nature of the data on municipal elections, the precise dates when municipal councils make their annual income surcharge rate-setting decisions are connected to the timing of both local elections and traditional celebrations. Two pieces of evidence emerge. On the one hand, a generally acknowledged result is confirmed: the probability to raise the local income tax rate is significantly higher during post-electoral than during pre-electoral months.

On the other hand, in terms of the impact of the timing of traditional celebrations on local fiscal policy-making, two potentially competing mechanisms might intervene. The first implies the idea that any tax hike decided by the incumbent government during period of celebrations will tend to have an amplified echo within the community and could possibly generate a stronger than usual opposition. As a result, incumbents would program potentially disruptive local tax decisions to a different time of the year. In contrast, a second observation arises: in the preparation of the celebrations it is also true that citizens may have less time to monitor what local governments are actually doing because they are too distracted and there might be a “panem et circenses” effect, i.e. incumbents might possibly try to take advantage of the electorate’s distraction to enact the potentially most unpopular fiscal determinations. According to the data, the former effect seems to prevail: local income tax-setting decisions are more likely to be scheduled far from celebration periods. This novel evidence is compatible with the idea that those events provide temporary but sizeable shocks to the connectedness, participation, and trust within a community, inducing incumbents to schedule potentially disruptive fiscal decisions to less sensitive times.

The last part of the analysis turns to the investigation of whether the interaction of the calendars of mayoral elections and of Patron Saint Day celebrations has an influence on the selection of mayors. Indeed, when elections happen to occur concomitantly with traditional religious celebrations, and particularly during the weeks preceding the Patron Saint Day, the elected mayors of those localities tend to be characterized by milder ideological affiliation and higher indicators of valence. This result corroborates the hypothesis that local folklore contributes to increasing the sense of cohesion and common value thinking of a community of the concurrence of sacred (Patron Saint Day) and profane (election day) events and lowering the ideological stakes of local races.